How Credit Repair Creates Long-Term Financial Stability

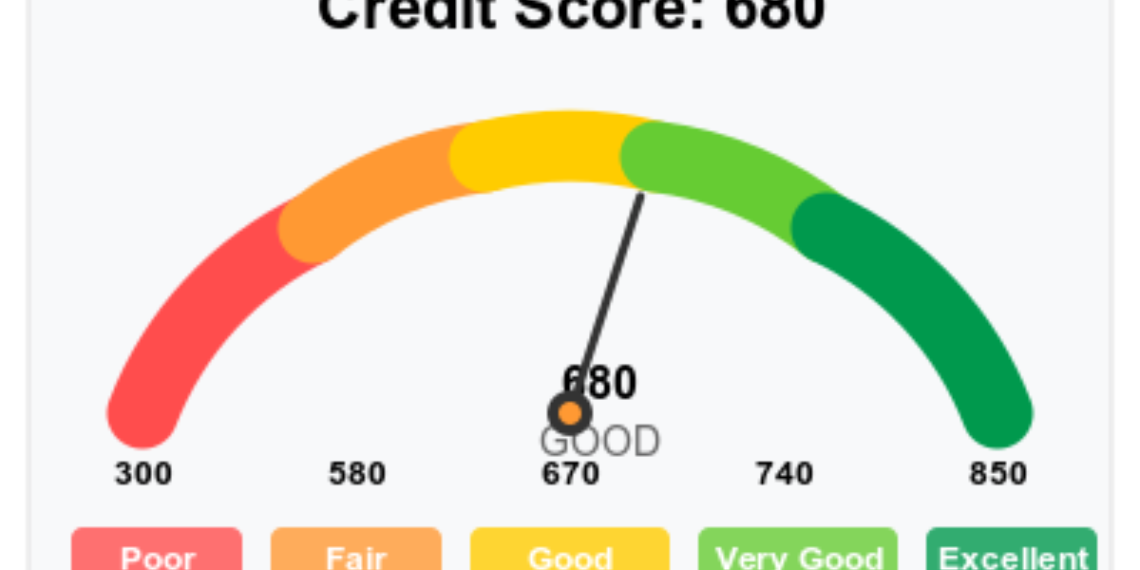

Building a solid financial future requires more than saving money—it also requires maintaining a strong credit profile. Your credit score influences nearly every major financial decision, from qualifying for loans to getting approved for an apartment. Unfortunately, many people discover issues on their credit only when they apply for credit and get denied. This makes credit repair not only helpful but essential for long-term financial health.

Credit repair focuses on identifying inaccurate information, correcting mistakes, and helping individuals rebuild their credit step by step. With more consumers becoming aware of how important their credit score is, the demand for quality credit repair services continues to grow. This rising interest has also fueled the popularity of the credit repair affiliate program, which allows marketers to earn income by recommending credit repair solutions.

Why Credit Repair Matters More Than Ever

Credit reports often contain errors—duplicate accounts, incorrect payment statuses, fraudulent information, or outdated negative items. Each of these mistakes can drastically affect a person’s credit score and limit financial opportunities.

Credit repair professionals help by:

-

Reviewing detailed reports from all three credit bureaus

-

Spotting inaccurate or questionable entries

-

Submitting disputes for correction or removal

-

Communicating with lenders and bureaus on behalf of the consumer

-

Offering guidance on improving credit habits

When these issues are addressed, consumers can see steady credit score improvements and greater financial flexibility.

The Growing Need for Professional Assistance

As people rely more on credit for major life purchases, they are also realizing how vital it is to maintain accuracy on their reports. With interest rates rising and loan requirements becoming stricter, consumers are turning to credit repair companies for help navigating disputes and improving their profiles.

This increase in demand has given bloggers, influencers, and online marketers new opportunities to earn through a credit repair affiliate program, which pairs them with companies that offer professional credit repair services.

What a Credit Repair Affiliate Program Offers

A credit repair affiliate program allows individuals to earn commissions by referring customers to credit repair companies. Affiliates receive unique tracking links and promote services through blogs, videos, social media posts, or online reviews.

Why these programs are popular:

-

Free to join

-

High consumer demand

-

Strong conversion rates

-

Access to marketing materials

-

Passive income potential

The structure is simple—affiliates promote a service that consumers already need, making it a powerful earning opportunity in the financial niche.

How Credit Repair Helps Consumers Regain Confidence

For many people, negative credit can feel overwhelming. Credit repair not only helps remove inaccuracies but also teaches consumers how to maintain strong financial habits going forward. This includes lowering credit utilization, making timely payments, and monitoring credit reports regularly.

With better credit comes better financial opportunities—lower interest rates, easier approvals, and increased peace of mind.

Final Thoughts

Credit repair has become a crucial step for anyone looking to improve their financial future. As awareness continues to grow, more consumers are turning to professional services for guidance. At the same time, marketers and creators have a chance to participate through a credit repair affiliate program, creating a mutually beneficial ecosystem. With both demand and impact rising, credit repair remains one of the strongest and most valuable niches in personal finance.

You May Also Like

How to Prepare Financial Statements for a Successful Business Loan Application

September 29, 2024

The Benefits of Lines of Credit for Small Businesses

August 25, 2024